2021 FICA Tax Rates

Por um escritor misterioso

Descrição

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Understanding FICA and How It Affects Your Primary Insurance Amount - FasterCapital

Medicare tax: Diving Deep into W2 Forms: Uncovering Medicare Taxes - FasterCapital

2019 Payroll Tax Updates: Social Security Wage Base, Medicare & FICA Tax Rates - CheckmateHCM

Social Security Administration Announces 2022 Payroll Tax Increase

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

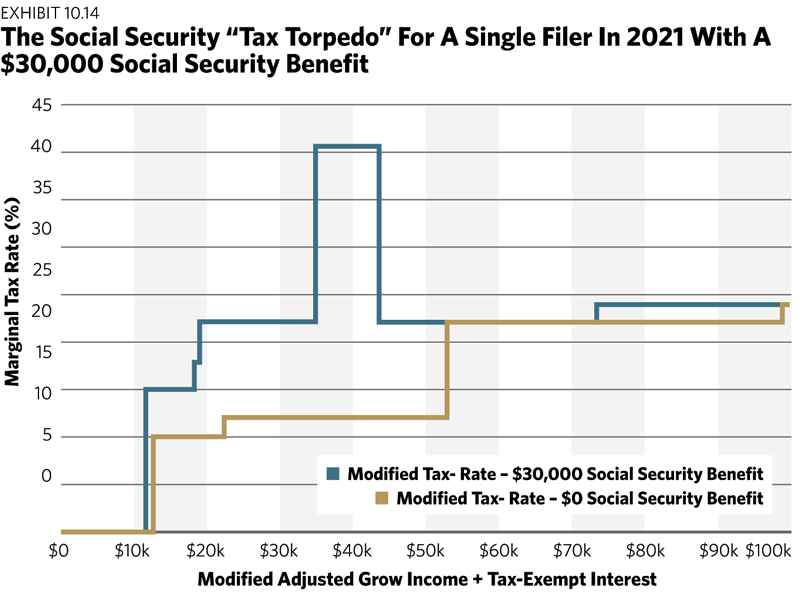

Avoiding The Social Security Tax Torpedo

Social Security and Taxes – Could There Be a Tax Torpedo in Your Future?

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Federal Insurance Contributions Act - Wikipedia

Historical Social Security and FICA Tax Rates for a Family of Four

de

por adulto (o preço varia de acordo com o tamanho do grupo)