Learn About FICA, Social Security, and Medicare Taxes

Por um escritor misterioso

Descrição

Learn about what FICA taxes are, withholding Social Security and Medicare taxes from employee pay, and how to calculate, report, and pay FICA taxes to the IRS.

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

Federal Insurance Contributions Act - Wikipedia

What Is FICA Tax: How It Works And Why You Pay

Overview of FICA Tax- Medicare & Social Security

:max_bytes(150000):strip_icc()/FICATaxes-3f6ed8206b52462ea8ff7a7c740ffafb.jpg)

FICA Tax Rates and the Benefits They Fund

FICA Tax: Understanding Social Security and Medicare Taxes

The Social Security tax rate for employees is 6.2 percent, a

What Is Social Security Tax? Calculations & Reporting Information

Learn About FICA Tax and How To Calculate It

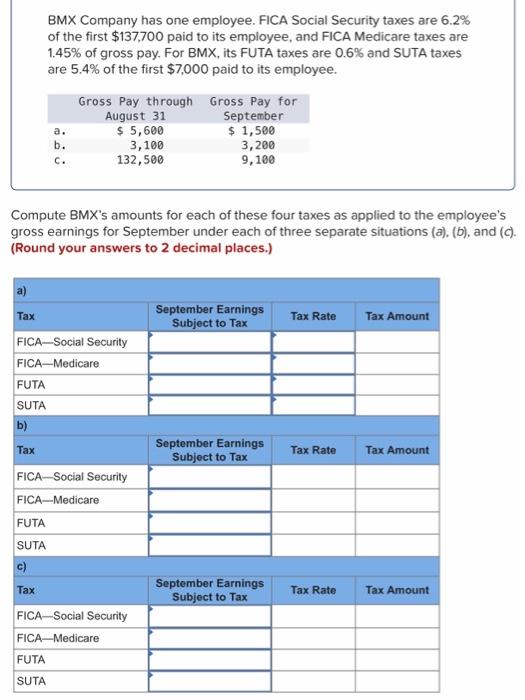

Solved BMX Company has one employee. FICA Social Security

Social Security Administration - “What is FICA on my paycheck?” Find out

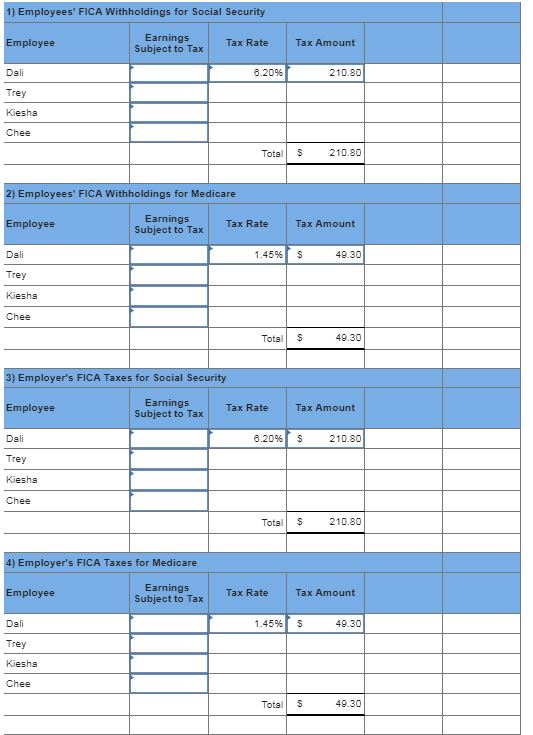

Solved Paloma Co. has four employees. FICA Social Security

de

por adulto (o preço varia de acordo com o tamanho do grupo)