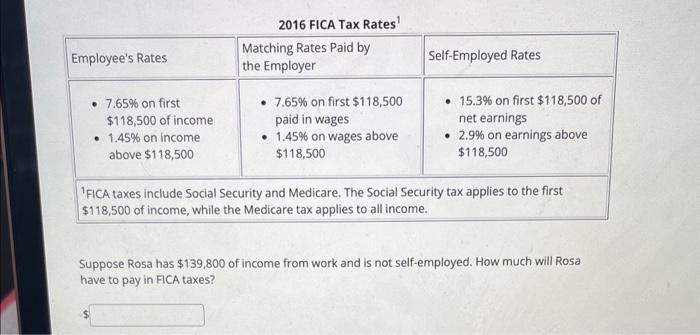

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social

Por um escritor misterioso

Descrição

Answer to Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social

Solved 2016 FICA Tax Rates 1 Suppose Rosa has $139,800 of

Using R&D credits to reduce payroll taxes: An overlooked opportunity for startups

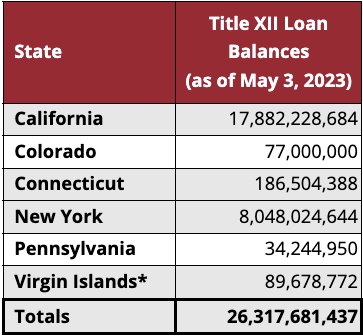

Outlook for SUI Tax Rates in 2023 and Beyond

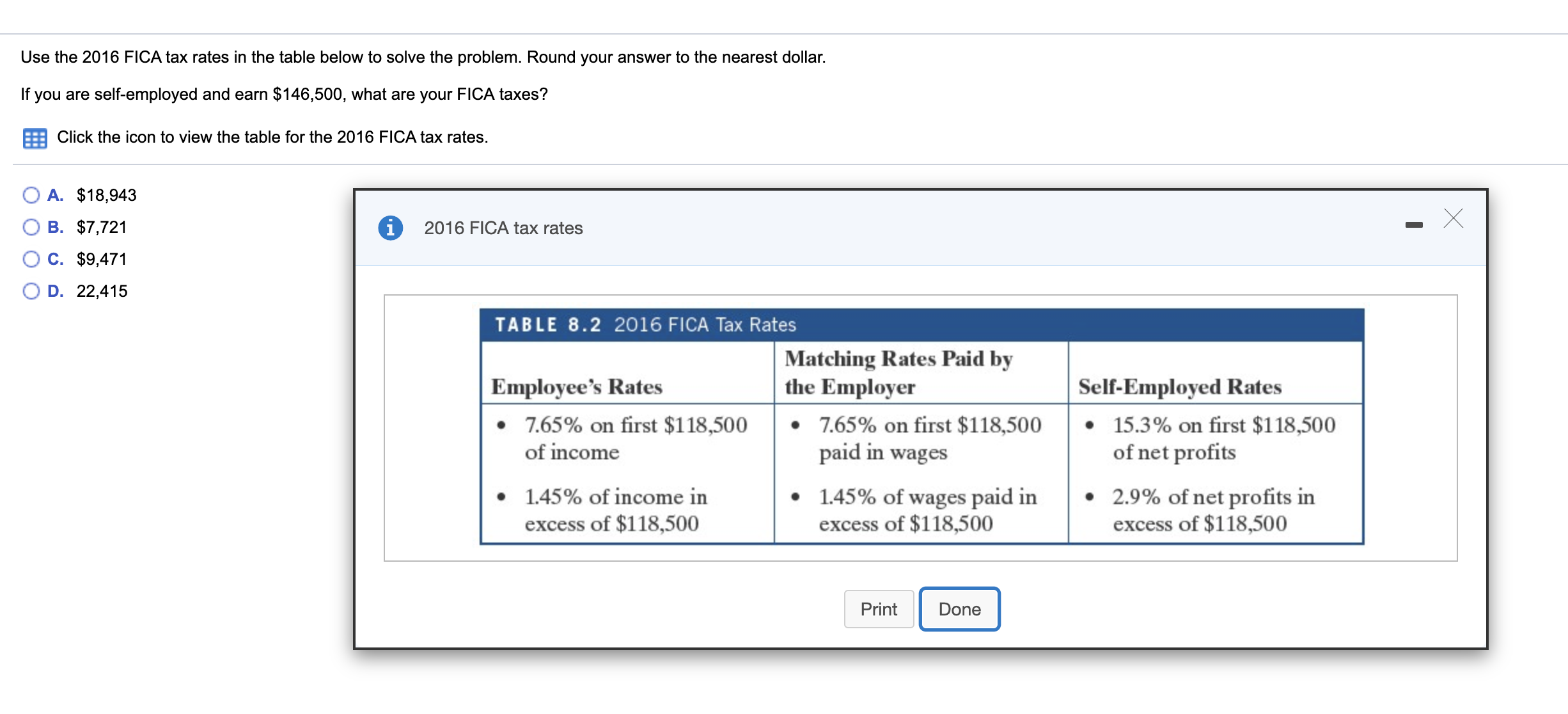

SOLVED: Use the 2016 FICA tax rates, shown below, to answer the following question. If a taxpayer is self-employed and earns 170,000, what are the taxpayer's FICA taxes? Employee's Rates Matching Rates

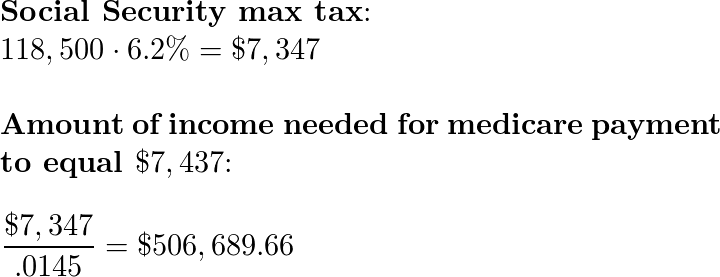

In 2016, the government took out 6.2% of earnings for Social

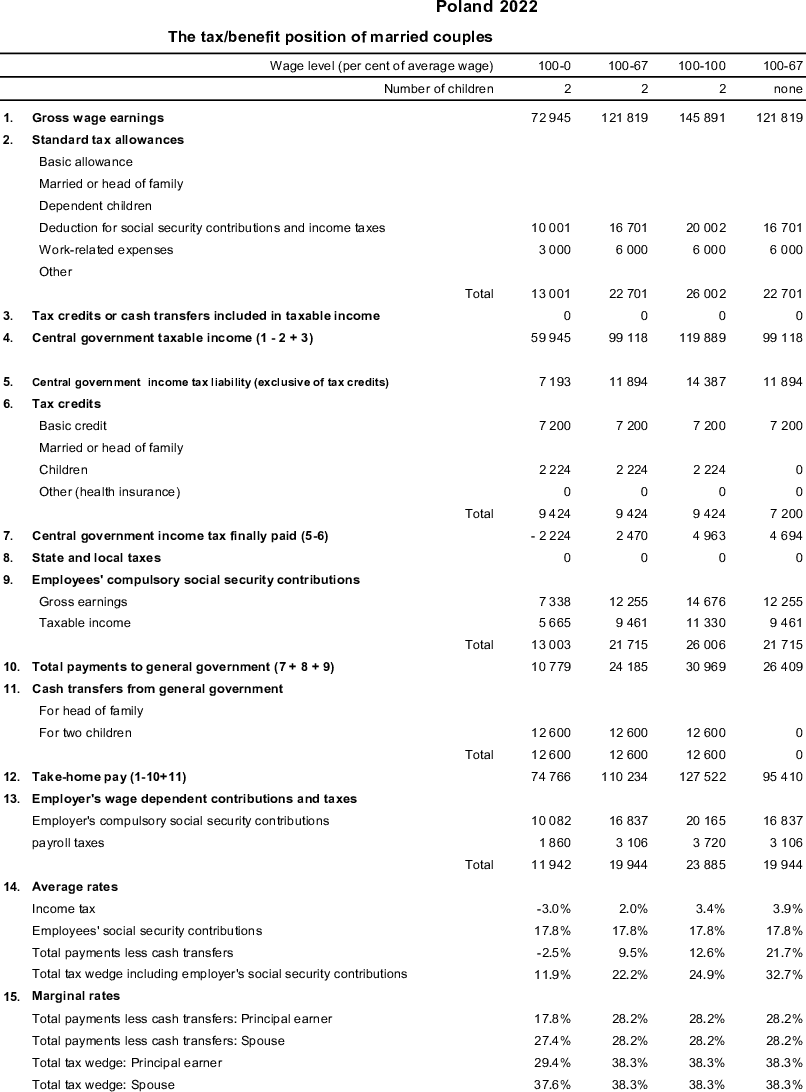

Poland, Taxing Wages 2023 : Indexation of Labour Taxation and Benefits in OECD Countries

Social Security: Evolution by Cohort - Conversable Economist

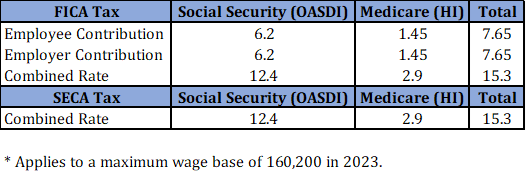

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

Social Security Financing: From FICA to the Trust Funds - AAF

How did the Tax Cuts and Jobs Act change business taxes?

:max_bytes(150000):strip_icc()/effectivetaxrate_final-cf3facabd80c4116bbf5923934956c34.png)

Effective Tax Rate: How It's Calculated and How It Works

Solved Use the 2016 FICA tax rates in the table below to

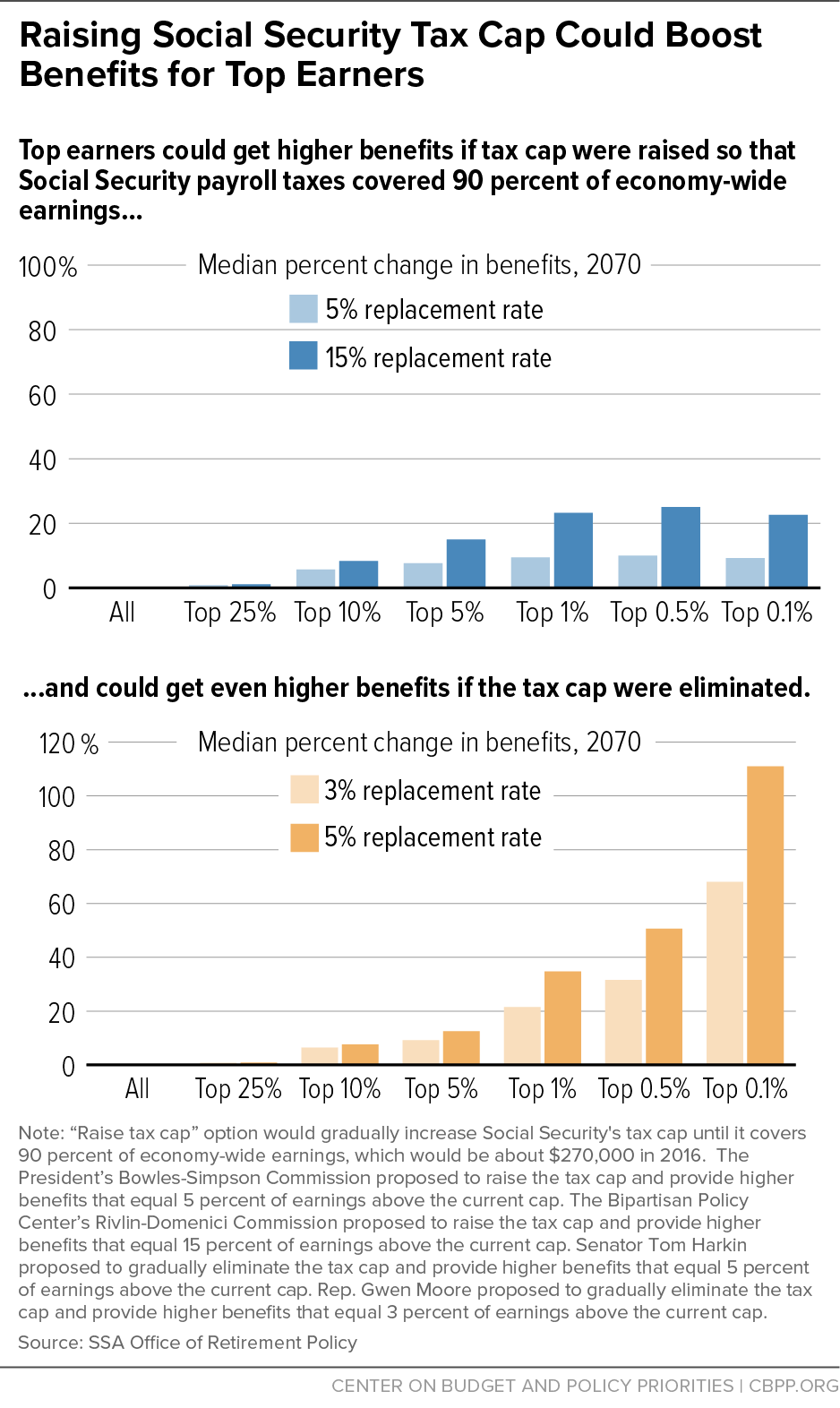

Increasing Payroll Taxes Would Strengthen Social Security

de

por adulto (o preço varia de acordo com o tamanho do grupo)