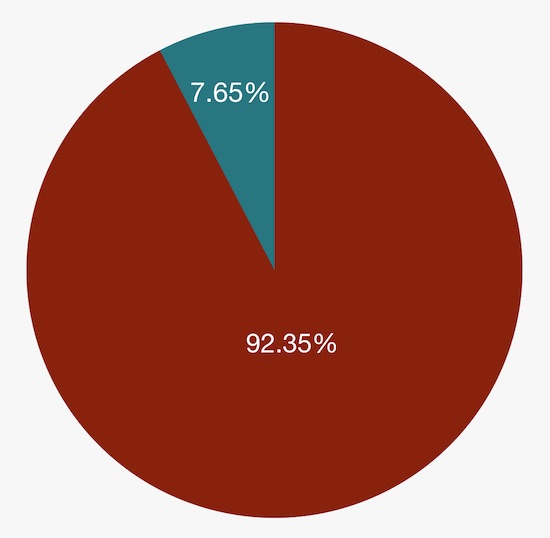

How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Descrição

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Self Employment Tax - FasterCapital

The Complete Guide to S Corporations for Therapists

How Much in Taxes Do You Really Pay on 1099 Income? - Taxhub

Converting to an S Corporation to Reduce Self-Employment Tax

How an S Corporation Can Reduce Self-Employment Taxes

Using an S corporation to avoid self-employment tax

Why You Should Form an S Corporation (and When)

What Is An S Corp?

What is a C Corporation? What You Need to Know about C Corps

S Corporation vs. LLC: Differences, Benefits

Are LLC Members Subject to Self-Employment Tax? - Thompson Greenspon

The Complete Guide to Self-Employment Taxes

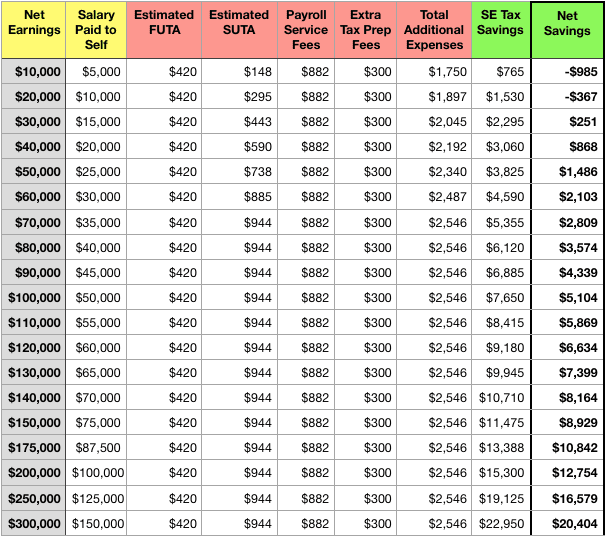

Here's How Much You'll Save In Taxes With an S Corp (Hint: It's a LOT)

Tax Benefits of S-Corps: How Does an S-Corporation Save Taxes? - Small Business Accounting & Finance Blog

de

por adulto (o preço varia de acordo com o tamanho do grupo)