MNCs sent tax notices over expat employees' allowances from foreign parent companies

Por um escritor misterioso

Descrição

The demands, ranging from ₹1 crore to ₹150 crore, cover the period between FY18 and FY22 for payments by foreign parent companies to expats working in Indian subsidiaries of MNCs

PDF) FACTORS INFLUENCE EXPATRIATES COMPENSATION IN MNC

IRS Letters and IRS Notices for American Expatriates

One giant step forward in Chinese IIT reform

The importance of shadow payroll for global businesses

Key Considerations for Expatriates Moving to India for Work

Download the full e-report (pdf) - Kromann Reumert

Decomposing Multinational Corporations' Declining Effective Tax Rates

P&H HC: Interim Relief to BMW India Against GST Notice on Salaries Paid to Expatriates

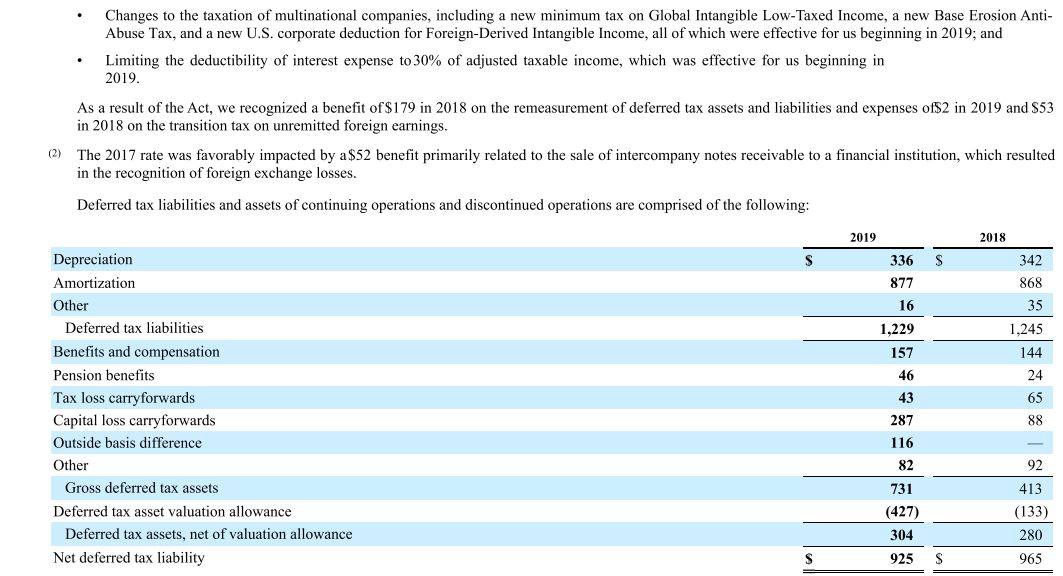

Income Tax: note 12 pg 67- 69 What is the effective

de

por adulto (o preço varia de acordo com o tamanho do grupo)