Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Por um escritor misterioso

Descrição

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

What's a W-2? Wage and Tax Statement Explained

1099 vs. W2: The Differences & Which Do Your Workers Need?

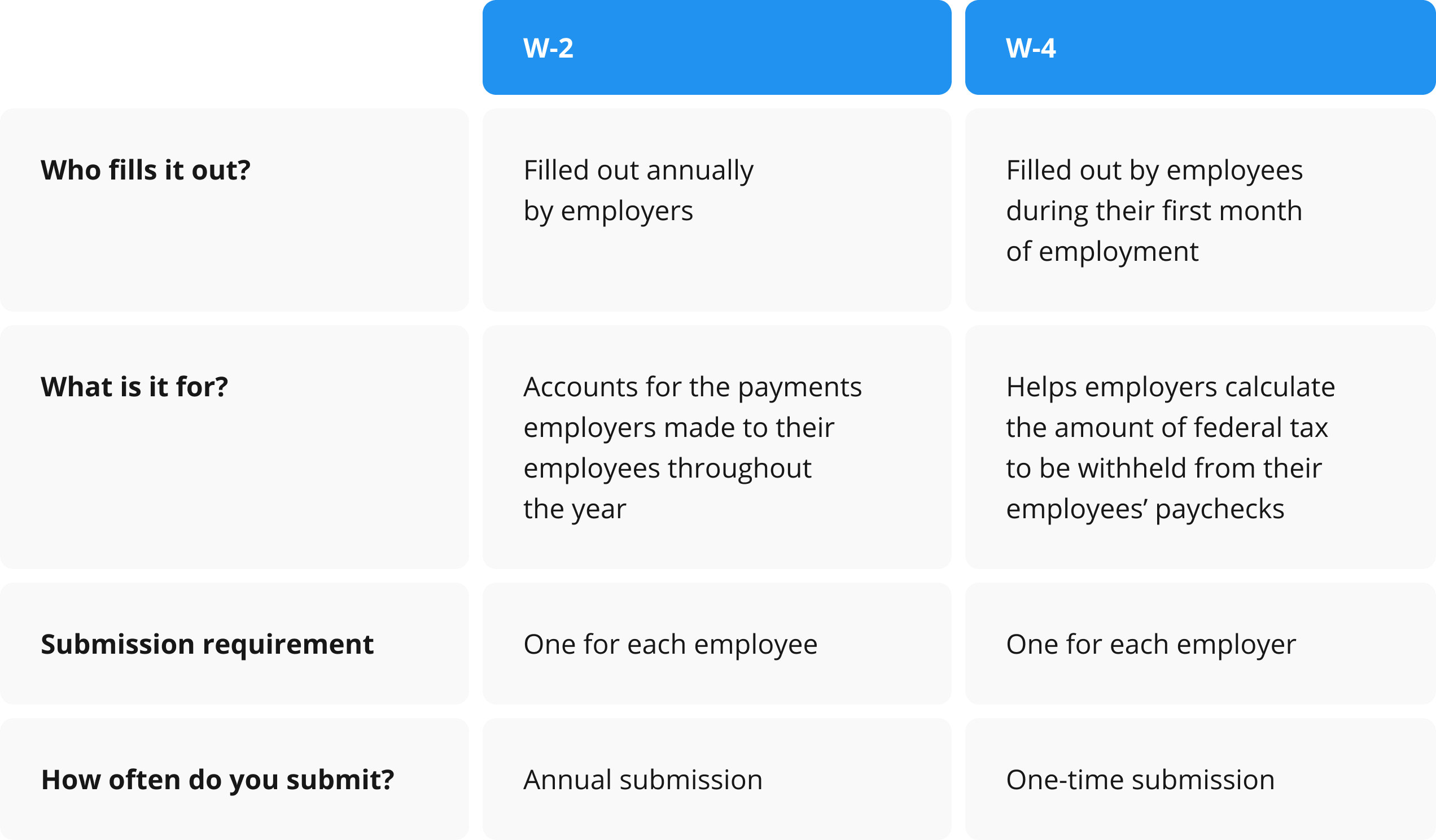

W-2 and W-4: What They Are and When to Use Them

Form W-2 H&R Block

1099 Vs. W-2 : What's The Difference? – Forbes Advisor

IRS Form 941 Filing Requirements for Businesses in the Beauty

Publication 505 (2023), Tax Withholding and Estimated Tax

W-2 Software: E-File, Printing, Forms

W-2 form - Wages and Tax Statement - pdfFiller Blog

W-2 form - Wages and Tax Statement - pdfFiller Blog

de

por adulto (o preço varia de acordo com o tamanho do grupo)